How's your pricing?

↓

0, 100, 212, 32, 98.6, 4.0, 1600, 1, 18, 21 — our brains crave numbers like these. Pegged into our grey matter, collecting meaning like flypaper. Lightweight, easy to share, ready to be summed, averaged, or compared, able to be sent through functions or transmitted over the web. The utility-to-storage ratio is immense.

And so it's no surprise when you ask a founder: "Hey, what's your pricing?", they'll lob back a series of numbers. 'It's just 19, 29, and 49!' 'We're 750, 1250, and our highest is 5000.' 'Oh, pretty traditional, 49, 99, and 149.'

Yet, if the startup is healthy, beneath this compressed fact 🐙 is a world of features, checkboxes, unit economics, and trade-offs. What's included 🐙 and what's not.

For something as complex as software, pricing isn't a number, it's a model — a space where demand meets supply. A market within a market where a buyer is free to look around and decide what they want while still paying a price the seller considers fair.

Designing this mini-market (for ants?!) is downright hard. Building it to last — to endure the next wave of demand with its new idiosyncrasies of 'I want this, but not that, and two of those, not one', is even harder.

When our deep love for integers causes us to ignore the fact that the numbers hide the complexity below the waterline, we launch by advertising a price rather than a conversation; and so we go to market with a 1 cart-powered horse.

By doing so, we learn next to nothing, which is worse than nothing, because at least if we were learning nothing, we'd have a clue that something was broken.

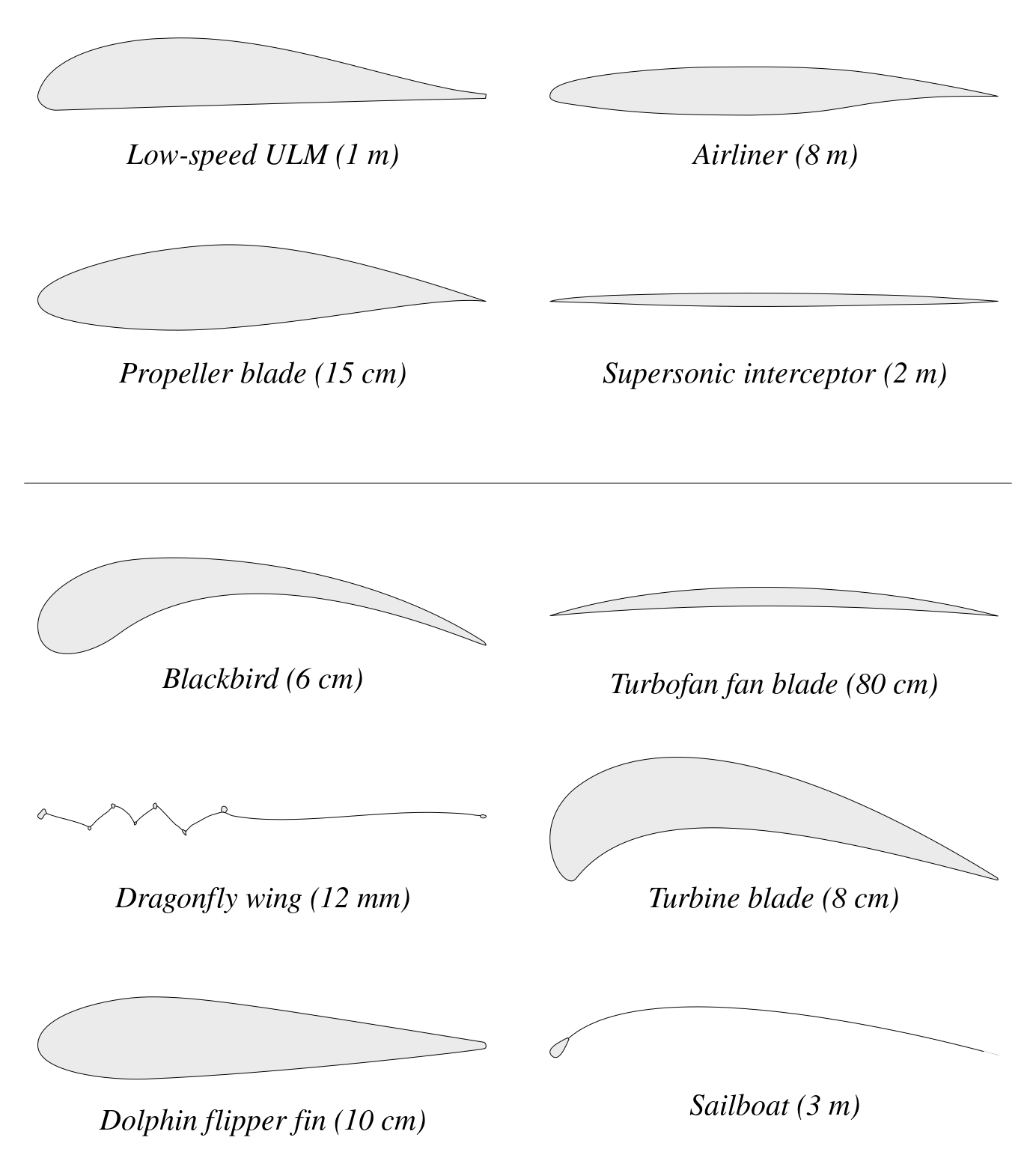

Pricing Creates Lift

Like an airfoil, your pricing is a shape designed to merge and marry the forces your business encounters in-market in order to give you lift. With the right pricing, your business takes off before reaching the end of your runway.

At its smallest quantum, this lift is positive unit economics: in layman's terms, when I sell one of these, I make more than it costs to provide it. While fuzzy at first, this is a good area for founders to focus, even and especially as CFO's invent ways to cloud the higher altitudes of profit and loss.

In theory, we'll get this lift as long as we create more value than we consume. We have receipts for the latter. To test the former (are we really creating something valuable?), we're told we need to figure out willingness-to-pay. Unfortunately, that's often reflected (once again) as a single number, which we resort to pogo-sticking around: "$200? $100? $149? Are we getting warmer? Colder?"

Is this a worthless exercise? Again, no. It's not nothing. But this is prone to error ("oops, I forgot to test another number on that call"), and the response of any individual to a single number ("How about $300?!") is hard to extrapolate to a segment, let alone a market.

Testing Behavior

We need to remember that what we're building isn't a number, it's a model.

To know if the embryonic version of a pricing model is any good, you bring it into the field and test two behaviors:

- How the prospect behaves in the context of our pricing model. Does it make them nervous? Is it clear? Do they worry what it will cost them eventually? Do they know what they're getting for that price today? Does it include 🐙 the features they need to get the value they want?

- How our model behaves in response to the prospect's demands. Is it decipherable or cagey? Is it flexible or rigid? Is it firm or accommodating? Does it generate a price that makes sense given the use-cases you're targeting?

In this light, the search for an initial pricing model isn't a game of hotter/colder or a binary search tree to arrive at a magic number. It is the gradual productization of the startup's side of the negotiation. It is, in practice, a bot composed of dimensions, limits, tiers, options, and discounts that yes, ultimately generates a number.

You, Pricing

A pricing model scales the success a founder has been achieving manually. It stands in her stead and speaks for her. It negotiates while she's sleeping, discounting, flexing, holding the line, and packaging until the customer finds the right fit.

Startups that skip the step of manual, founder-led sales, and instead opt for a set of neat integers — stolen from a competitor's pricing page or "just what companies like ours do" end up lacking the DNA necessary to build an innovative model. In its place, they prop up the output of a model and hope for the best.

Don't settle for the outline of a business. Learn how to build a business.